A Georgia pastor and tax preparer is in trouble with the law after federal authorities indicted him on charges of COVID-19 recovery assistance fraud.

This, according to a press release that the U.S. Attorney’s Office for the Southern District of Georgia published this week.

That man, Mack Devon Knight, 45, of Kingsland, is charged in a five-count indictment. The indictment accuses him of lying to the Small Business Administration (SBA) in connection with applications for Economic Injury Disaster Loans (EIDLs), the press release said.

“As described in the indictment, in February and March 2021, Knight applied for EIDLs on behalf of two Camden County, Georgia businesses: Knight’s Tax Services, and Daddy Earl’s Kitchen. Those EIDL applications falsely affirmed that the businesses each had hundreds of thousands of dollars of gross revenue prior to the COVID-19 pandemic. The indictment alleges that Knight then made and transmitted to the SBA a falsified bank document to deceive the SBA into approving one of Knight’s EIDL applications,” according to the press release.

“The indictment further alleges that, after receiving $149,900 from the SBA as a result of false and fraudulent representations in Knight’s loan application on behalf of Knight’s Tax Services, Knight used part of the funds to buy a Mercedes-Benz S-Class sedan.”

The charges carry a statutory penalty upon conviction of up to 30 years in prison, along with substantial financial penalties, followed by a period of supervised release. There is no parole in the federal system, the press release said.

This alleged COVID-19 fraud is only one of several cases that federal officials have announced this year in Georgia.

In July, a federal grand jury returned a 12-count indictment charging a Sycamore, Georgia, resident with bank fraud, money laundering and making false statements related to the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

In June, two other Georgia residents — in separate cases — allegedly committed massive CARES Act fraud.

Meanwhile, an Augusta woman admitted to submitting loan applications containing knowingly false representations in an effort to secure COVID-19 relief loans.

In March, a Georgia woman admitted to creating a fake business and using it to receive funding from a federal COVID-19 small business relief program.

The CARES Act included direct payments of $1,200 to taxpayers who earned $75,000 or less – $2,400 to couples who earned $150,000 or less – in 2019. Every dependent in the household was another $500 in direct payments. The act included $350 billion in forgivable small interest loans and expands unemployment benefits by $600 per week. Part-time, self-employed and gig workers were also eligible for unemployment benefits.

– – –

Chris Butler is an investigative journalist at The Tennessee Star. Follow Chris on Facebook. Email tips to chrisbutlerjournalist@gmail.com.

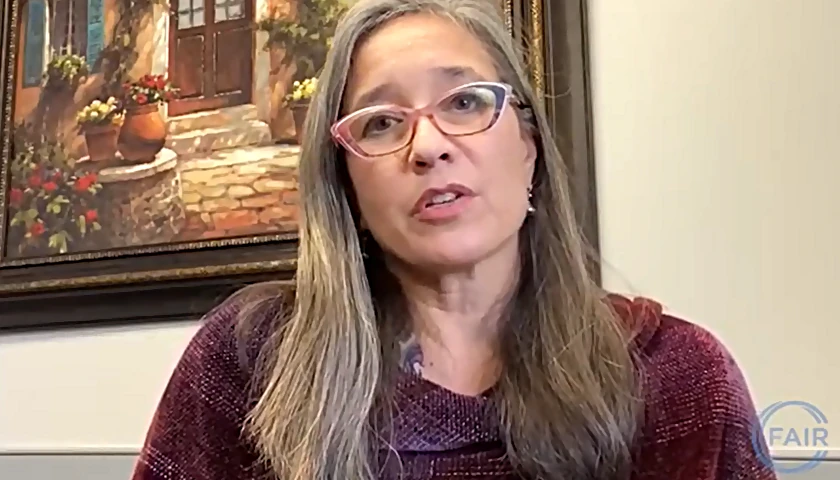

Photo “Mack De’Von Knight” by Mack De’Von Knight.

Sign up here to get your copy of The Georgia Star News Daily Update

Daily updates, breaking news, special offers, and more